Key Takeaways

- The Texas homestead exemption protects your primary residence, offering unlimited home equity protection if eligibility criteria are met.

- To qualify for the Texas homestead exemption, you must have lived in the state for at least 1,215 days before filing.

- The exemption covers up to 10 acres in urban areas and up to 100 acres (200 acres for families) in rural areas, protecting homes from liquidation.

- The Texas homestead exemption is more beneficial than the federal exemption, which caps at $25,150, especially for homeowners with significant equity.

- At Debt Redemption Texas Debt Relief, we help Texans protect their homes and resolve high-interest debt through personalized debt relief programs.

The information contained is this article is not legal advice and Debt Redemption is not a law firm. If you would like to speak with a bankruptcy attorney, Debt Redemption can recommend a highly rated Texas bankruptcy law firm to assist.

Debt Redemption Texas Debt Relief is a trusted debt relief company in Texas dedicated to helping consumers overcome their financial challenges. We offer personalized solutions including a debt settlement program exclusively offered only to Texans, a debt consolidation loan platform to shop for the best rates, and access to credit counseling solutions via our partners, to help you reduce and manage debt effectively. With a commitment to transparency and customer support, Debt Redemption Texas Debt Relief provides free consultations to guide you towards financial freedom.

As seen on Good Morning Texas, Texas Today, Great Day Houston, Great Day SA, We Are Austin and Daytime

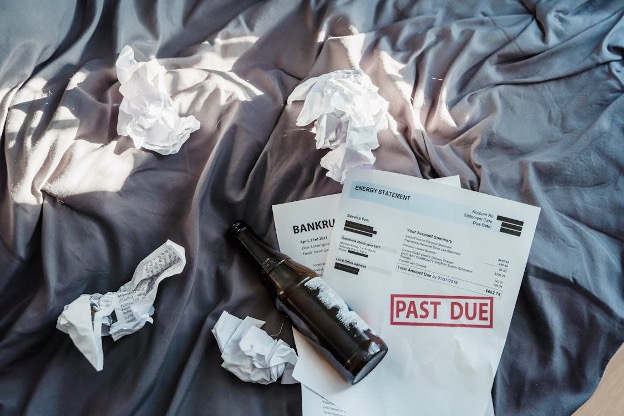

Explanation of Chapter 7 Bankruptcy

Chapter 7, known as “liquidation bankruptcy,” allows you to discharge unsecured debts if you can’t repay them through a repayment plan. A trustee liquidates your non-exempt assets to pay creditors, and remaining unsecured debts are discharged, offering a fresh start.

Eligibility Criteria and Liquidation Process

To qualify for Chapter 7 bankruptcy, you must pass a means test comparing your income to the Texas median. If your income exceeds the median, Chapter 13 may be a more suitable option.

During the liquidation process, non-exempt assets—those not protected by exemptions—are sold to repay creditors. In Texas, the homestead exemption protects primary residences, but other assets may not qualify for exemption.

Examples of Non-Exempt Assets:

- Second homes or vacation properties

- Expensive vehicles beyond the exemption limit (e.g., luxury cars)

- Valuable jewelry or collectibles

- Cash savings above protected limits

- Investment accounts not tied to retirement funds

Texas exemptions help protect necessary personal property, but assets like vacation homes or high-value items are subject to liquidation. This protection allows you to keep essential belongings while non-exempt property is sold to repay creditors

Overview of Texas Homestead Exemptions

What is a Homestead Exemption?

A homestead exemption shields your primary home from creditors during bankruptcy. Texas provides more extensive protection compared to federal exemptions, particularly for homeowners with high equity.

Texas Homestead Exemption Specifics

- Residency Requirement: You must have lived in Texas for at least 1,215 days before filing.

- Urban Areas: Covers up to 10 acres.

- Rural Areas: Protects 100 acres for individuals and 200 acres for families.

Comparison with Federal Exemption

- Federal Exemption – Capped at $25,150 (as of 2019).

- Texas Exemption – Offers unlimited home equity protection, making it more advantageous for homeowners with substantial equity.

Protecting Your Home During Chapter 7

In most cases, homeowners in Texas can retain their primary residence by meeting the requirements for the homestead exemption. Any acreage beyond the protected limits (10 acres urban or 100 acres rural) may be subject to liquidation.

Homestead Exemption Application and Requirements

To successfully apply for the homestead exemption when filing Chapter 7 bankruptcy in Texas, you must meet specific criteria. These requirements ensure that only qualifying properties benefit from the exemption:

- Primary Residence: Your home must serve as your primary residence. Vacation homes or rental properties are not eligible.

- Residency Requirement: You must have lived in Texas for 1,215 days before filing. If not, federal exemption caps apply.

- Acreage Limits: Urban homes can cover up to 10 acres, and rural properties can include 100 acres for single filers or 200 acres for families

How Debt Redemption Texas Debt Relief Can Help

At Debt Redemption Texas Debt Relief, we specialize in providing debt relief exclusively for Texans. With over 22 years of experience since 2002, we understand the specific rules, regulations, and benefits unique to Texas. Our debt settlement program, offered only to Texans, is often a much better alternative to bankruptcy, helping many resolve high-interest debt in as little as 12-60 months.

If you’re concerned about keeping your home while filing for Chapter 7 in Texas, we can provide educational information and refer you to a qualified Texas bankruptcy attorney for legal assistance. While we do not directly provide debt consolidation loans, we can connect you with our affiliate platform to explore options of up to $100,000. Our debt negotiation fees are up to 40% less than out-of-state services, and in many cases, program payments are often less than half compared to minimum credit card payments.

Visit Debt Redemption Texas Debt Relief to learn how we can help you protect your home and achieve financial stability.

Book your free consultation

Frequently Asked Questions (FAQ)

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy lets individuals discharge most unsecured debts by liquidating non-exempt assets. In Texas, the homestead exemption can protect your primary residence during this process.

How do I apply for a homestead exemption in Texas?

To apply, your home must be your primary residence, and you must have lived in Texas for at least since January 1st of the tax year before filing the claim for that year. Claim the homestead exemption on your bankruptcy forms, ensuring proper documentation. We provide educational information and can refer you to a qualified Texas bankruptcy attorney for legal assistance.

What happens to my home equity in Chapter 7?

The Texas homestead exemption protects home equity from liquidation. If your home qualifies, you can keep your home and its equity.

Are there any limitations to the Texas homestead exemption?

The exemption covers up to 10 acres in urban areas and up to 100 acres (200 for families) in rural areas. Excess acreage may be liquidated.

Can I choose between state and federal exemptions?

Yes, but Texas exemptions are often more beneficial, especially for homeowners. The Texas homestead exemption offers unlimited protection for home equity, while the federal exemption is capped at $25,150.

How long do I need to live in Texas to qualify?

You must have lived in Texas since January first of the tax year to qualify for the homestead exemption.

What other assets can I protect in bankruptcy?

Texas also protects personal property, including vehicles, household items, and retirement accounts.

Why should I choose Debt Redemption Texas Debt Relief?

Debt Redemption Texas Debt Relief offers expert guidance. Our debt settlement program is often a better alternative to bankruptcy, helping resolve high-interest debt in 12-60 months while protecting your home.